Shareholder Advocacy

This process starts by examining an issue, followed by engaging with the relevant company to change its behaviour, reporting and actions with regards to that issue.

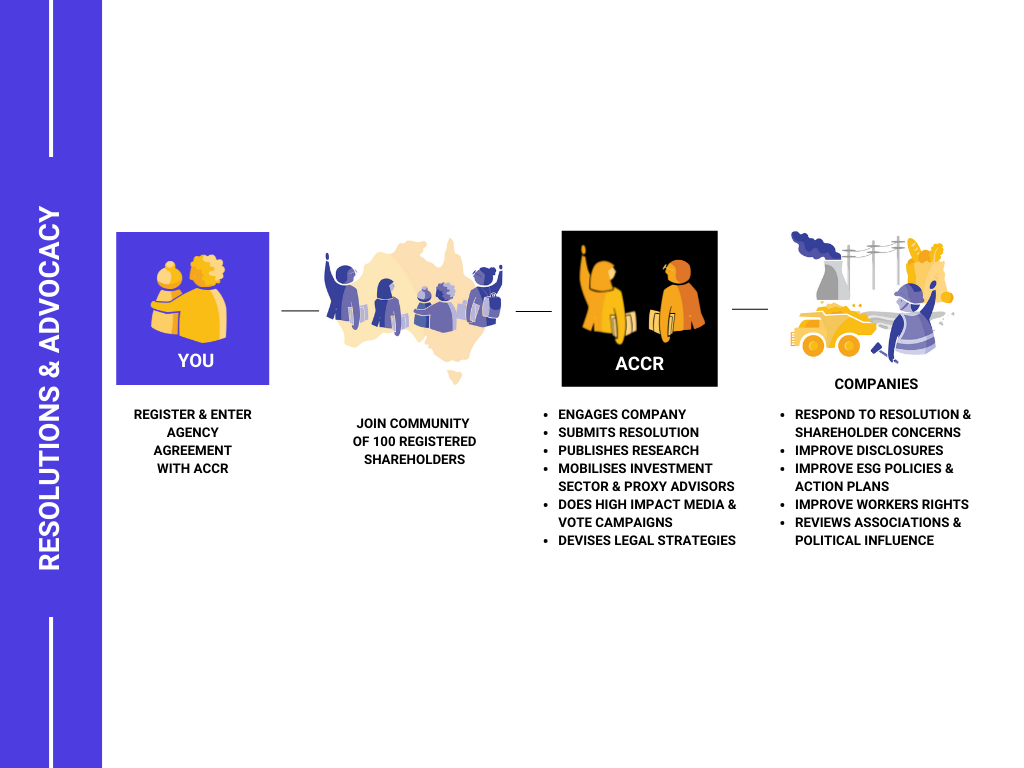

If an engagement is unsuccessful, shareholder advocates can then take their issue to all shareholders, investors and other stakeholders at the company annual general meeting (AGM). Shareholders can ask questions, distribute statements or file shareholder resolutions together with at least 100 other shareholders. If you successfully put a resolution forward, then experience in the USA, UK and Australia shows us that it is not necessary to get a majority vote to achieve a significant impact. As little as 3% of the shares voting in favour of a resolution in the first year it is put forward is usually sufficient to achieve some change; a vote of 10 to 15% will likely result in the change sought being agreed to.

Putting a resolution forward at an AGM also means that other shareholders will consider the issue. This is especially relevant for large institutional shareholders such as super funds that own a large part of large Australian listed companies. These institutional investors all have members (in the case of super funds) or investors and they are sensitive to their concerns. This means they will probably give your resolution serious consideration and while they may not vote for it, their added concerns may mean that companies respond to the issues put forward.

ACCR has facilitated shareholder advocacy and resolutions on many ESG issues and with your support, will continue to do so.

A Quick Guide to Shareholder Advocacy

- Research your issue and the companies involved.

- Engage with the company (letters, face to face etc). If your issue is not resolved, ask others to engage with the company by contacting other interested people, bodies and the media.

- If this does not resolve the issue, you could find like-minded shareholders in the company or become a shareholder yourself, and start to ask questions at an AGM. You could discuss next steps with ACCR.

- Table a statement or resolution at an AGM. To do this you will need to find 100+ shareholders, to word your statement or resolution in accordance with company law and lodge it before the due date.

- Have companies communicate progress appropriately with shareholders, the media and ASX.

Shareholder advocacy is not the same as divestment

Divestment is the opposite of an investment – it simply means getting rid of stocks, bonds, or investment funds that are unethical or morally ambiguous whereas shareholder advocacy and resolutions are a pathway for those who own shares in companies to express their desire for change and make the companies they own accountable for their conduct.

Divestment has taken on great significance as a global movement as more individuals and institutions take action to ensure their money is not being used to fund projects and industries that they don’t agree with. While divestment can send a signal of disapproval, in divesting shareholders lose their access to the company and open up the possibility that their shares may be purchased by a less ethical buyer.

ACCR believes divestment (selling your shares) is appropriate when you cannot influence a company any longer and should be used as a last resort after all engagement to do better has failed. Rather than divesting completely, many shareholders maintain a reduced or minimum holding to keep the door open for the mechanisms of shareholder participation described above.