Woodside’s growth portfolio: what’s in it for shareholders?

What if an oil and gas company could deliver more value for shareholders without further emissions growth?

Our analysis of Woodside Energy Group’s growth portfolio reveals the company’s portfolio of unsanctioned oil and gas projects does not appear to be a material source of value for shareholders. Reallocating the capital from these uncompetitive fossil fuel projects to a share buyback appears to offer more value and less risk than delivering them, and would avoid half a billion tonnes of greenhouse gases from being released into the atmosphere, making it a win for shareholders and a win for the climate.

Woodside has a strong balance sheet and a portfolio of operating and sanctioned projects that can deliver strong cash flow for a long time. Taking on marginal and risky projects could put this in jeopardy.

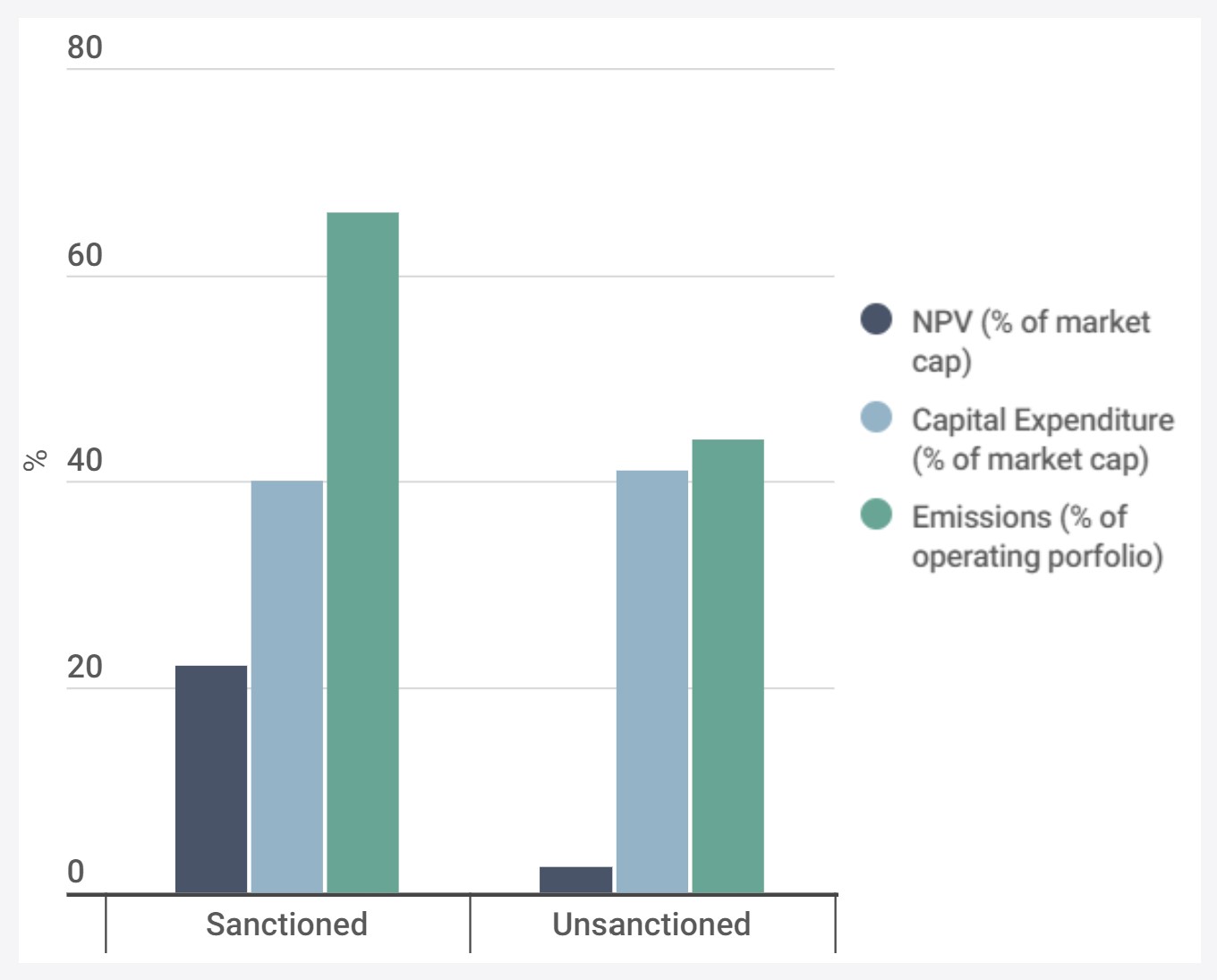

Woodside’s sanctioned project portfolio presents a material value opportunity at 22% of market capitalisation (albeit, with high emissions). However, its unsanctioned projects, at 2.5%, appear immaterial especially in consideration of the amount of capital expenditure (41% market cap) required for these projects.

Chart 2-1: NPV and capex of Woodside’s sanctioned and unsanctioned projects

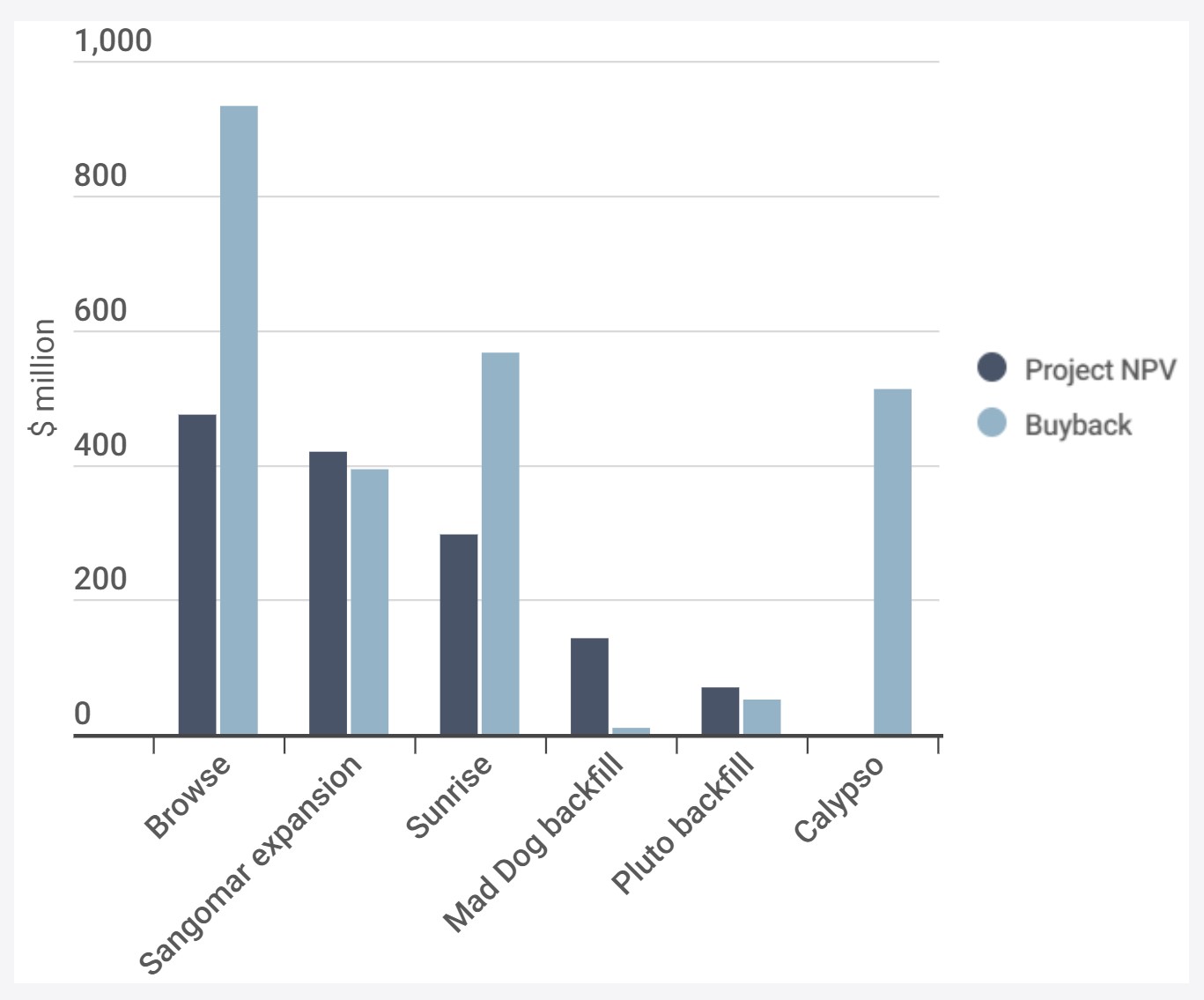

Our analysis suggests that as a portfolio, Woodside’s unsanctioned projects create less value than a share buyback. The few projects that do create incremental value over a share buyback, do not justify the expense of Woodside maintaining its project development capabilities.

Chart 1-1: Value of delivering each unsanctioned project compared to using the capital for a share buyback

Woodside's commitment to growth appears to be overlooking a higher value, lower risk and lower emissions alternative. The board’s continued pursuit of fossil fuel growth is putting Woodside’s strong balance sheet in jeopardy and investors should ask the Board to do better.

Read our full report here.