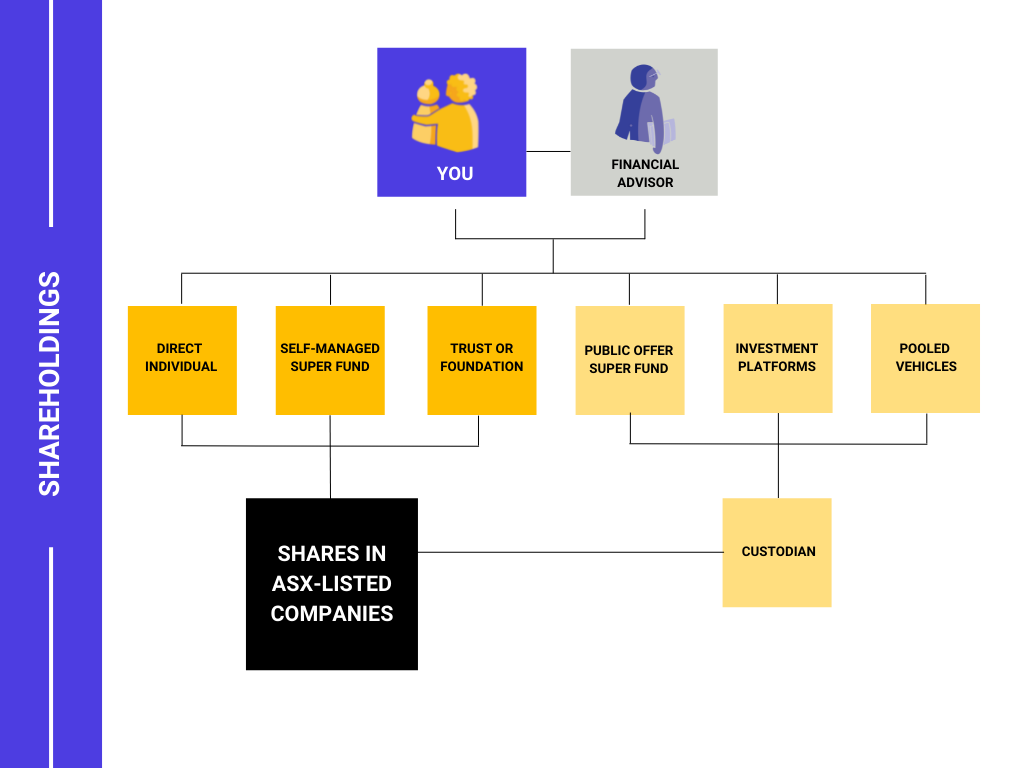

Shareholding Structures

Direct holdings are shares which are owned by the shareholder, either as an individual or through a trust or a SMSF that the individual controls. Indirect holdings are shares which are owned by funds or vehicles that pool shareholder money to buy or sell assets.

Direct ownership of shares allows the owner to make use of their voting rights while indirect ownership places the responsibility with those that run the fund. Shareholders who own shares indirectly are sometimes known as beneficial owners. Institutional shareholders generally hold their shares indirectly but in a manner in which they can vote. Retail shareholders, individuals or non-professional shareholders who buy and sell shares through brokerage firms generally hold their shares directly.

Direct Ownership Methods

Under these direct ownership methods, you have a "Holder Identification Number" (HIN) or a “Securityholder Reference Number” (SRN) in the stock exchange's registry, CHESS. You're registered with the ASX as the legal owner and you will receive mail or electronic communications directly from the companies you invest in, inviting you to shareholder meetings or telling you how much you'll get in dividends.

Individual Holdings

This refers to a minimum parcel of shares in a company which are held directly by the person or entity in their own name. This allows you full control over your shares and you are able to vote as a shareholder in the company in which you hold a stake in.

Your shareholding entity may typically look like this, eg. Ms Jane Smith, but may also be in the name of your business. You can register individual shareholdings with us to support ACCR’s shareholder resolutions.

Self Managed Super Fund (SMSF)

A SMSF is a private super fund that you manage yourself. When you manage your own super, you put the money you would normally put in a retail or industry super fund into your own SMSF. You choose the investments and the insurance. Therefore, a SMSF can invest in direct shares, enabling the members to have control of their shareholdings.

Your shareholding entity name may typically look like this, eg. Jane Smith <Jane’s Self-Managed Super Fund>. You can register your SMSF shareholdings with us to support ACCR’s shareholder resolutions.

Trust Fund

A trust fund is a legal entity that holds and manages assets on behalf of another person, group or organization. A trust fund can include money, property, stock, a business or a combination of these. Therefore, a trust fund can have direct investment in shares with the shareholder of the shares being the trustee ‘as trustee for’(ATF) the trust. This is because a trustee holds assets on behalf of the trust, allowing control of their shareholdings.

Your shareholding entity name may typically look like this, eg. Jane Smith <Jane’s Family Trust>, but may also be in the name of your organisation or corporation. You can register a trust’s shareholdings with us to support ACCR’s shareholder resolutions.

Indirect Ownership Structures

Indirect shares are shares that hold a fractional interest in company stock, such as mutual funds or exchange traded funds (ETFs). Under this method, your broker or fund manager uses a custodian or nominee company to hold the shares bought on your behalf. The custodian is the registered owner of your shares, even though you are what lawyers call the "beneficial owner" along with many other beneficial owners and creditors with a claim on that company's assets. For example, if you want to invest in US shares, most Australian brokers do it through a custodian.

An investment platform is similar to a broker in that it allows you to make online transactions to buy, hold and sell securities and managed funds. Platforms can also offer a more diverse range of options including wholesale managed investments, private equity, and term deposits. However, in the case of an investment platform, they will usually use a custodian to hold investments on behalf of clients.

You cannot register indirect shareholdings with us. To find out if your investment platform is using a custodian, refer to their most recent Product Disclosure Statement (PDS) or contact their customer support.

Eligible to enter an agency agreement

By registering your eligible shareholdings with us, you are entering into an agency agreement. The agency agreement enables ACCR to sign a request to the company secretary requesting that the company include the resolution on the forthcoming notice of meeting for an Annual General Meeting (AGM). It also enables ACCR to vary or withdraw such a request.

The agency agreement does not allow ACCR to access your shareholdings or act as your proxy regarding the voting of your shares on any resolution.

If you would like assistance in registering or have any further questions, please do not hesitate to contact us at shareholderse@accr.org.au.

Financial Advisors

More and more people are wishing to invest their money in meaningful and ethical ways. Financial advisors can be a link between their clients and ACCR, by providing them with the means to participate in meaningful shareholder activism.

The way your clients' shares are held determine whether or not they are able to participate in shareholder resolutions. Please get in touch with us at shareholders@accr.org.au if you have any questions. We look forward to working with you and your clients.