A closer look at lobbying

Climate-related policy engagement and lobbying activity is a significant issue for investors. The lobbying actions of the world’s biggest companies could ensure policy makers are supported to implement the bold laws and incentives required to keep the world within 1.5C of warming and to avoid severe physical climate risks. Or their lobbying activities could constrain ambition, slow progress against climate change targets and push for more fossil fuel extraction projects that put global climate goals further out of reach.

There is an urgent need for positive climate policies that incentivise carbon abatement. When companies engage with public policy makers, either directly or indirectly through industry associations, they have a responsibility to encourage cost-effective measures that mitigate climate change risks and will support the transition to a low carbon economy. Good policy can also support company commitments to shareholders as part of agreed plans to decarbonise over the coming years.

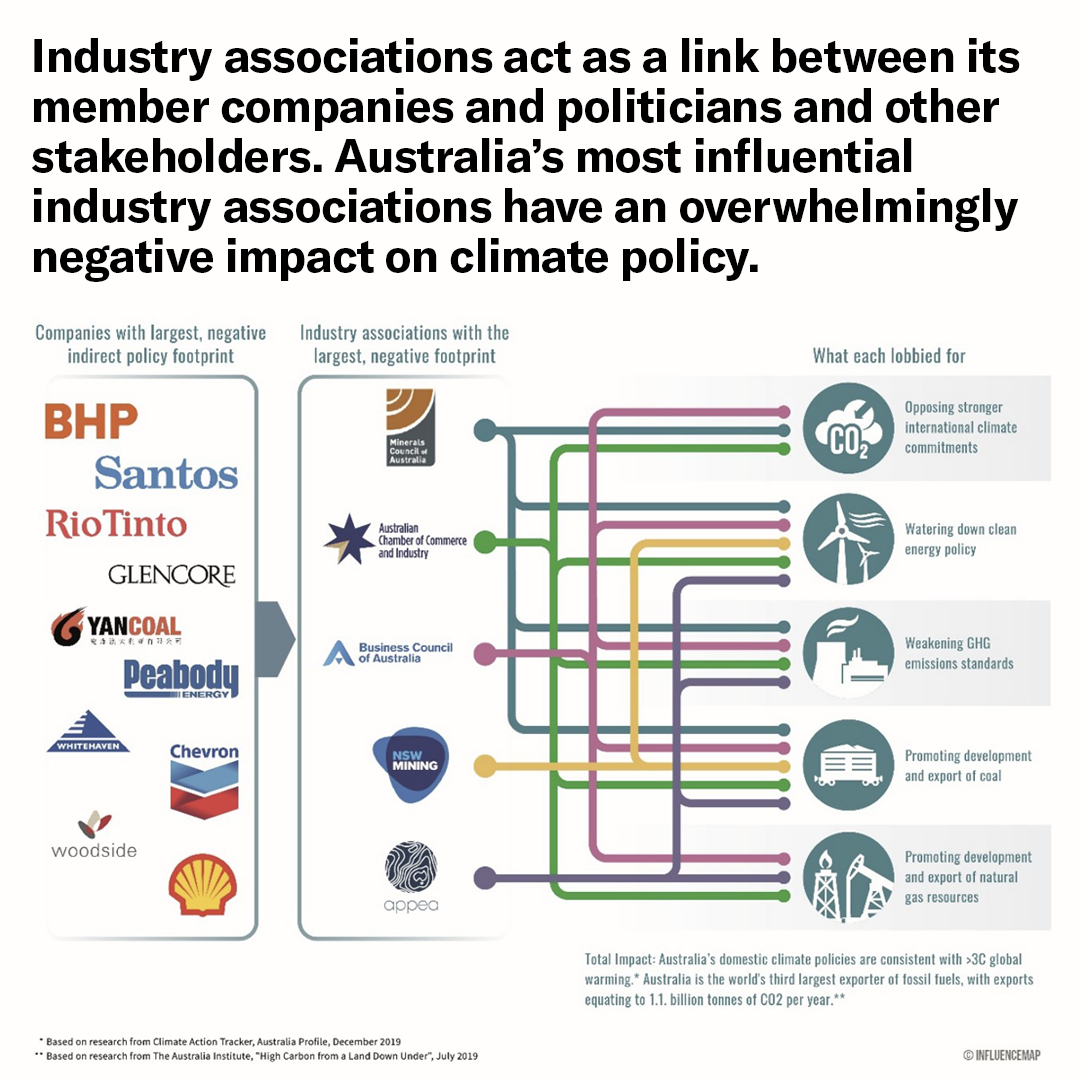

Many of the biggest companies channel their resources (and investors’ funds) into lobbying activities that are mis-aligned with the Paris Agreement, by promoting the ongoing and expanded use and production of fossil fuels. This negative climate lobbying is a problem that still persists today, particularly by the industry associations representing coal and gas extraction.

What can investors do about climate-related lobbying?

Call out hypocrisy

Look at the climate commitments of your companies and check these against advocacy statements, submissions and media releases. Look out for any mis-alignment. Does the company put forward messages that support more ambitious climate action, or could these statements hold climate policies back? Seek disclosure of political donations by companies and their industry associations and ask what influence these donations have had on climate-related policies.

Assess advertising

Fossil fuel companies are incredibly likely to promote their green credentials, while failing to be upfront about the polluting impact of the vast majority of their business activities. Many companies have extensive PR and advertising footprints, promoting solar panels and wind farms, green flames, net zero and happy communities. Investors and regulators are becoming more attuned to greenwashing and to monitoring advertising and PR messages that could be considered misleading or deceptive.

Investors can request to see the advertising activities of their companies, and can use tools like the facebook ad library to track social media advertising.

Monitor the activity of industry associations

Shareholder funds are used to pay the membership fees for these industry associations. Investors should engage with their companies to ensure that industry associations reflect shareholder interests in all lobbying, advertising & media activities.

Where an industry associations’ position on key issues is at odds with either the positions of the companies they represent, or globally endorsed best practice, you could say membership fees are a misuse of shareholder funds and hold your company accountable.

ACCR is encouraging companies to disclose more information in their industry association reviews. Investors need to see more than superficial alignment on top level messages of support for net zero and the Paris Agreement. More detail is required to be able to assess:

- any advocacy undertaken that could impact progress towards Paris-aligned climate policy and the required emissions reduction pathway for your company

- political donations made by the industry association

- ministerial meetings (federal and state) attended by the industry association

- key matters of policy engagement during the period including major submissions

- advertising campaigns run

Investors have a critical role to play in curtailing the impact of company and industry association lobbying on evolving Australian climate policy. Read our investor bulletin.