Briefing note

Investor briefing: Shareholder Resolutions to AGL Energy Ltd on coal closure dates

AGM date and location: 7 October 2020, Sydney, Australia.

Contact: Dan Gocher, Director of Climate and Environment

Other key links: Resolutions and Supporting Statements.

Background

ACCR has engaged with AGL Energy (AGL) for several years on its approach to decarbonisation, and its relationship with industry associations that advocate on climate and energy policy.

In 2015, AGL announced that it would close its three coal-fired power stations at the end of their operating lives — Liddell by 2022-23[1], Bayswater by 2035 and Loy Yang A by 2048[2].

In 2019, a shareholder resolution requesting the closure of its three coal-fired power stations by 2030 was supported by 30% of AGL shareholders.

In 2019, ACCR filed a shareholder resolution requesting the disclosure of the cost of modern pollution controls in order to reduce community health impacts. It was supported by 11% of AGL shareholders.

ACCR met with AGL executives and board members several times in the last year. While AGL’s latest scenario analysis implicitly acknowledges the inconsistency between the Paris Agreement’s objectives and the technical lives of AGL’s coal-fired power stations, the company has not signalled its intention to bring forward closure dates to align with the Paris Agreement, and has not disclosed a strategy for early closure.

AGL executives said, in conversation with ACCR, that there are three factors that would accelerate the closure of its coal-fired power stations:

- Government regulation;

- Changes in community and consumer attitudes;

- Investor expectations.

In his previous role as CFO, current CEO Brett Redman convinced the AGL board to acquire Loy Yang A in 2012, and Bayswater and Liddell in 2014[3]. In May 2019, Redman told the Australian Financial Review, “what we were foreseeing back then, which is still what’s playing out today, was that the shift to the low-carbon economy was always going to take a long time”.[4]

Ordinary Resolution on Coal Closure Dates

Shareholders affirm our company’s commitment to decarbonisation and welcome the FY20 scenario analysis.

Shareholders request that our company align the closure dates of the Bayswater and Loy Yang A coal-fired power stations with a strategy to limit the increase in global temperatures to 1.5°C above pre-industrial levels.

Nothing in this resolution should be read as limiting the Board’s discretion to take decisions in the best interests of our company.

Scenario Analysis

AGL’s latest scenario analysis[5] (see below), published in June 2020, clearly shows that in order to limit global warming to 1.5°C above pre-industrial levels, AGL would have to close its three coal-fired power stations by approximately 2036.

Electricity generation is the largest source of emissions in Australia, accounting for 32.9% of emissions in the year to December 2019[6]. AGL’s operational greenhouse gas (GHG) emissions in FY20 were 42.2 Mt CO2-e[7], or approximately 8% of Australia’s total emissions; Liddell contributed 1.9%, Bayswater 2.6% and Loy Yang A 3.2%.

As at June 2020, coal-fired power accounted for approximately 70% of grid-level generation (excluding rooftop solar)[8] in the National Electricity Market (NEM). The decarbonisation of electricity generation is crucial if Australia is to deliver its commitments under the Paris Agreement.

The executive director of the International Energy Agency (IEA), Fatih Birol, said of Australia’s coal-fired power stations, “if they don’t retire early or if we don’t use technology which decarbonises existing plants is the issue…if they continue to operate as they run then it is impossible. We can forget reaching these hard climate targets”[9].

In 2015, Tim Nelson (AGL’s then Chief Economist) and Cameron Reid (AGL’s then Rehabilitation and Transition Program Manager) found that three-quarters of Australia’s thermal fleet was operating beyond its original design life[10]. Nelson and Reid concluded that “the current mix of plants within the NEM is sub-optimal, capacity factors are plunging, and by implication the thermal efficiency and overall productivity of the power station fleet must be declining”. They urged policy makers and market participants, such as AGL, to “correct these material imbalances” through plant retirements[11].

Government Relations

Following the announcement that it would close the Liddell coal-fired power station in 2022-23, AGL came under sustained pressure from the Australian government and conservative media throughout 2017 and 2018, to extend Liddell’s operating life[12]. Many of the attacks were directed at AGL’s former CEO, Andy Vesey[13], culminating in Vesey’s departure in August 2018.

In August 2019, Australia’s Minister for Energy and Emissions Reduction, Angus Talyor, established the Liddell Taskforce[14] to address concerns about reliability and electricity prices, beyond Liddell’s closure. AGL’s plans to replace Liddell with renewables, storage, demand management and gas generation has satisfied the Australian Energy Market Operator (AEMO)[15], and largely quelled any further criticism of the closure of Liddell.

AGL would be unlikely to face comparable criticism if it brought forward the closure dates of Bayswater and Loy Yang A, given both will close after 2030, and the way in which AGL has handled the closure of Liddell.

Capital Expenditure

In October 2018, AGL confirmed that it would allocate approximately $900 million in capital expenditure to Loy Yang A between 2016 and 2021[16]. AGL also confirmed that Loy Yang A would require significant investment in the late 2020s, in order to extend its life beyond 2038. Following an investor site visit to Loy Yang A in October 2018, it was reported that AGL’s Group Operations Executive Manager, Doug Jackson, said “the company's goal was for Loy Yang A to make it to 2038 – 10 years short of its scheduled closure – and generation beyond that date would depend on the market”[17] (see chart from presentation below). AGL Loy Yang General Manager Steve Rieniets subsequently clarified that the comments were made “in the context of capital expenditure planning” and that Loy Yang A would close “no later than 2048”[18].

AGL acquired Loy Yang A in June 2012, and Bayswater and Liddell in September 2014. Since FY2012, stay-in-business or ‘sustaining’ capital expenditure has grown from $80 million to $536 million in FY2020. Conversely, spending on ‘growth and transformation’ has declined from $690 million in FY2012 to $193 million in FY2020. ‘Sustaining’ capital expenditure has grown from just 10% of total capital expenditure in FY2012 to 74% in FY2020.

This allocation of capital expenditure suggests AGL’s maintenance of its coal-fired power stations is coming at the expense of accelerating the energy transition.

Despite its claims to be Australia’s “largest private investor in renewable energy”, the share of AGL’s electricity output produced by renewable sources - including energy offtake agreements - has increased only marginally, from 9% in FY2015 to 10% in FY2020.

Electricity Output by Primary Energy Source, 2015-20

| GWh | FY15 | FY16 | FY17 | FY18 | FY19 | FY20 |

|---|---|---|---|---|---|---|

| Black coal | 19,832 | 24,489 | 24,042 | 22,764 | 23,900 | 24,928 |

| Brown coal | 14,833 | 14,395 | 14,544 | 15,517 | 14,641 | 13,456 |

| Wind | 2,465 | 2,558 | 2,271 | 2,649 | 2,918 | 3,524 |

| Gas | 1,629 | 2,520 | 2,827 | 2,784 | 2,557 | 2,471 |

| Hydro | 1,155 | 1,164 | 834 | 814 | 1,175 | 715 |

| Solar | 9 | 316 | 354 | 374 | 364 | 318 |

| Landfill gas, biomass and biogas | 111 | 103 | 110 | 126 | 23 | 0 |

| Diesel | 1 | 2 | 1 | 2 | 3 | 2 |

| Renewables % | 9.06% | 8.87% | 7.69% | 8.52% | 9.78% | 10.03% |

Carbon Intensity

In the year to 30 June 2020, the carbon intensity of AGL’s operated generation assets was 0.94 tCO2-e/MWh, compared to the average intensity in the NEM of 0.72 tCO2-e/MWh[19].

Since FY2015, the average intensity in the NEM has declined by 21%, (from 0.91 to to 0.72 tCO2-e/MWh), while the carbon intensity of AGL’s operated assets has declined just 3%[20].

| tCO2e/MWh | FY15 | FY16 | FY17 | FY18 | FY19 | FY20 |

|---|---|---|---|---|---|---|

| Average market intensity | 0.91 | 0.90 | 0.88 | 0.82 | 0.77 | 0.72 |

| AGL operated intensity (all generation) | 0.97 | 0.96 | 0.98 | 0.97 | 0.95 | 0.94 |

| Bayswater | 0.90 | 0.95 | 0.95 | 0.94 | 0.93 | 0.95 |

| Liddell | 1.00 | 1.01 | 0.98 | 0.97 | 0.96 | 0.99 |

| Loy Yang A | 1.30 | 1.28 | 1.30 | 1.29 | 1.26 | 1.26 |

Of AGL’s power stations, Loy Yang A has the highest carbon intensity at 1.26 tCO2-e/MWh, followed by Liddell at 0.99 tCO2-e/MWh, and Bayswater at 0.95 tCO2-e/MWh[21]. Even after Liddell closes in 2022-23, the carbon intensity of AGL’s generation assets will likely remain well above the average intensity in the NEM.

In August 2020, the Australian Energy Regulator reported that the contribution of wind and large-scale solar to the total generation mix had increased from 7% to 13% in the three years to June 2020[22]. The Chair of Australia’s Energy Security Board, Kerry Schott, recently said “Australia’s coal power stations are increasingly becoming uneconomic and operating at razor thin margins, amid big falls in wholesale power prices as more renewables enter the electricity grid”[23].

Age & Reliability

According to its Greenhouse Gas Policy, AGL will not extend the operating life of any of its coal-fired power stations[24]. However, AGL’s definition of “operating life” is malleable; it intends to operate Loy Yang A for much longer than Liddell and Bayswater. AGL’s plan is to operate Liddell and Bayswater to roughly 50 years of age, and Loy Yang A well beyond 60 years of age[25].

| Start date | Scheduled closure date | Age at retirement (years) | |

|---|---|---|---|

| Liddell | 1971-73 | 2022-23 | 50-52 |

| Bayswater | 1985-86 | 2035 | 49-50 |

| Loy Yang A | 1984-87 | 2048 | 60-64 |

Macquarie Generation (the state-owned entity that formerly controlled Bayswater and Liddell) issued its final annual report in 2014, in which it estimated the useful lives of the those two power stations at 50 years[26].

Since 2012, 10 coal-fired power stations have been retired from the NEM at an average age of 40 years[27]. The average age of retirement of coal-fired power stations globally is just 38 years[28].

According to the Electric Power Research Institute (EPRI), globally as at 2017, very few coal-fired power stations are operating beyond 50 years of age[29], and none are operating beyond 60 years of age.

As coal-fired power stations age, reliability declines and the cost of maintenance increases. According to the Australian Energy Market Operator (AEMO), “the growing amount of renewable generation increases the variability in the system”, increasing reliance on the remaining thermal power stations “that have an increased risk of forced outages”[30]. Furthermore, “the reliability of the aging thermal generation fleet has deteriorated and the warming climate has increased the risk of extreme temperatures and high peak demands”.[31]

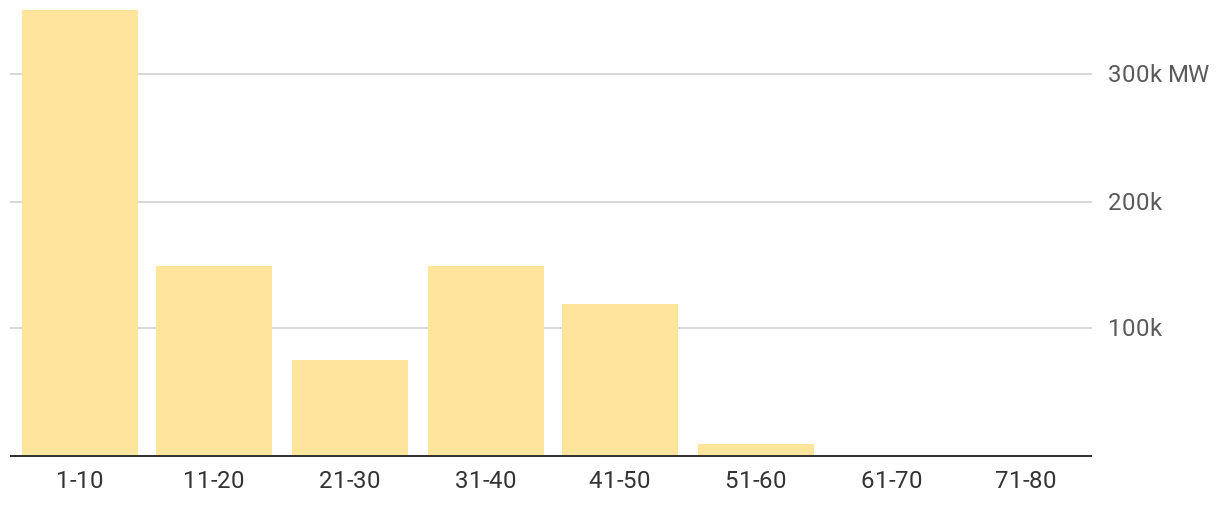

Age of existing coal-fired power stations globally (2017)

Between December 2017 and December 2019, coal and gas-fired power stations in the NEM experienced 227 unscheduled outages, or breakdowns[32]. AGL accounted for 54 of those 227 breakdowns: 30 at Loy Yang A, 16 at Liddell and 8 at Bayswater[33]. Loy Yang A was the second-worst performing power station in the NEM by number of breakdowns, and Loy Yang A Unit 2 was the fourth-worst performing unit[34].

Loy Yang Unit 2 was out of service from May 2019 to January 2020, due to an unplanned outage, which contributed to a 22% decline in AGL’s underlying profit after tax in FY2020[35].

Safety

The deterioration of coal-fired power stations as they age poses a threat not only to the reliability of the grid, but also to the health and safety of the workers that keep them running. The NSW Energy and Environment Minister, Matt Kean, affirmed this in March 2020, noting that Liddell "obviously becomes more dangerous" as it ages[36].

Chief among the problems faced by ageing coal-fired power stations is the risk of “high temperature creep cracking”, resulting in possible boiler tube failures[37]. Such deterioration has potentially catastrophic risks. In 2016, 21 people were killed and five injured following an explosion at a coal-fired power station in Dangyang, China, due to a burst steam pipe[38].

Prior to the closure of the 52-year-old Hazelwood coal-fired power station in March 2017, the Australian state of Victoria’s work safety authority required the owner, Engie, to upgrade and repair multiple boilers in order to meet health and safety standards[39]. Ultimately, Engie could not justify the estimated $400 million cost of those upgrades[40].

Given the major outage at Loy Yang A Unit 2 throughout much of 2019, it is likely that AGL will face similar safety challenges as its power stations approach 50 years of age.

Just Transition

AGL has committed to close its Liddell coal-fired power station without any forced redundancies, opting instead to provide the workforce with retraining. A number of options have been discussed for the repurposed site, including battery storage and pumped hydro. This has been welcomed by the key workers’ representative organisation[41].

A transition that is fair to AGL’s workforce and their communities requires active planning and management. If costly safety risks force unplanned closures of ageing power stations – as occurred at Hazelwood – AGL will be unable to deliver on its just transition rhetoric.

If management takes their public commitments to just transition seriously[42], the company should accelerate the closure of Bayswater and Loy Yang A with clear transition plans, in order to provide certainty to the workforces at those power stations. Allowing the market to decide the fate of Loy Yang A, as was reported in October 2018[43], would not be in the best interests of employees.

Air Pollution

Air pollution from coal-fired power stations has adverse public health impacts, contributing to heart disease, strokes, asthma attacks, low birth weight of babies, lung cancer and type 2 diabetes[44]. Research, partly funded by AGL, found that air pollution from NSW’s five coal-fired power stations is estimated to lead to 98 early deaths every year[45]. Air pollution from Loy Yang A is likely to have similar adverse public health impacts.

Conclusion

AGL’s own 2020 scenario analysis and research by its own former staff in 2015 suggests that the early closure of Baywater and Loy Yang A is not only possible, but desirable. ACCR urges shareholders to support the resolution calling for closure consistent with a 1.5°C pathway.

Note on Special Resolution

The Australian Corporations Act 2001 (Cth) (the Act), as interpreted by courts, is not conducive to the right of shareholders to place ordinary resolutions on the agenda of the annual general meeting (AGM) of any listed company. While s249N of the Act sets out a general right of 100 shareholders or those with at least 5% of the votes that may be cast at an AGM propose resolutions for discussion at the company AGM, courts have interpreted this provision to restrict these rights to the proposal of special resolutions, i.e., resolutions amending the company constitution (ACCR v CBA [2015] FCA 785; affirmed in ACCR v CBA [2016] FCAFC 80).

The solution to this problem, in practical terms, is for a group of members meeting the statutory threshold to propose one special resolution to amend the company constitution in order to permit the proposal of ordinary resolutions by members, followed by an ordinary resolution (or resolutions) on the issues of substantive engagement. This is the accepted ‘Australian way’ of proposing shareholder resolutions.

A special resolution requires 75% support to be legally effective, and no resolution of this kind has ever succeeded in Australia. In this legal environment, it is all but assured that contingent, ordinary resolutions proposed by members will have no legal force. ACCR, however, uses this method to compel non-binding votes of shareholders. A large vote on an ordinary resolution to an Australian-listed company can be highly persuasive, but is never binding on the company.

Further, ACCR’s preferred special resolution drafting limits the scope of permissible ordinary resolutions to advisory resolutions related to “an issue of material relevance to the company or the company's business as identified by the company.”

In combination, the restrictive Australian legal environment under the Act, and the conservative method proposed by ACCR, are extremely deferential to the management powers of a company board (as per s198A of the Act). Shareholders should have no concern that any resolution proposed by ACCR will legally compel the activities of any company board, nor limit any board's capacity to make decisions in the best interests of a company.

In this context, we encourage institutional investors to use the opportunity to vote on non-binding Australian shareholder resolutions to send a signal (without binding effect) to boards and management, in line with ambitious readings of their policies. This makes the situation in Australia the same as that in the US where similar shareholder proposals are advisory. In the UK both directive and advisory proposals are possible.

AGL originally announced that Liddell would close entirely in 2022 ↩︎

AGL Energy, Greenhouse Gas Policy, April 2015 ↩︎

Australian Financial Review, ‘AGL CEO urges ‘steely-eyed approach on energy transition’, 10 May 2019 ↩︎

ibid. ↩︎

AGL Energy, Climate Statement and Commitments, June 2020 ↩︎

Australian Government, Quarterly Update of Australia’s National Greenhouse Gas Inventory: December 2019 ↩︎

AGL Energy, FY20 ESG Data Centre ↩︎

The Australia Institute, National Energy Emissions Audit, June 2020 ↩︎

The Australian, ‘Call to retire coal-fired power stations early’, 21 July 2020 ↩︎

Nelson et al, ‘Energy-only markets and renewable energy targets: complementary policy or policy collison?’, Economic Analysis & Policy 46, 2015, p25-42 ↩︎

ibid. ↩︎

The Guardian, ‘Coalition MPs attack AGL decision to shut Liddell coal power station’, 10 December 2017 ↩︎

Sydney Morning Herald, ‘Tarred or feathered, AGL's Vesey shows no sign of budging over Liddell’, 6 April 2018 ↩︎

Angus Taylor MP, Minister for Energy and Emissions Reduction, ‘Liddell Taskforce to address reliability and power prices’, 9 August 2019 ↩︎

Renew Economy, ‘AEMO says AGL plans more than enough to replace Liddell’, 23 March 2018 ↩︎

AGL Energy, AGL Loy Yang investor site tour, 23 October 2018 ↩︎

Latrobe Valley Express, ‘Loy Yang to remain until 2048: AGL’, 25 October 2018 ↩︎

ibid. ↩︎

AGL Energy, FY20 ESG Data Centre ↩︎

ibid. ↩︎

AGL Energy, FY20 Results Presentation, 13 August 2020 ↩︎

Australian Energy Regulator, Wholesale markets quarterly - Q2 2020, 14 August 2020 ↩︎

The Australian, ‘Yallourn emissions will decide future of EnergyAustralia’s power plant’, 6 August 2020 ↩︎

AGL Energy, Greenhouse Gas Policy, April 2015 ↩︎

Jotzo et al, ‘Coal transition in Australia: an overview of issues’, September 2018 ↩︎

Macquarie Generation, Annual Report 2013-14, p38 ↩︎

ibid. ↩︎

Global Energy Monitor, January 2019 ↩︎

Electric Power Research Institute (EPRI), Power Plant Statistics, 2017 ↩︎

AEMO, 2019 Electricity Statement of Opportunities, August 2019 ↩︎

ibid. ↩︎

The Australia Institute, Fossil fails in the Smart State, February 2020 ↩︎

ibid. ↩︎

ibid. ↩︎

AGL Energy, FY20 Results Presentation, 13 August 2020 ↩︎

Sydney Morning Herald, ‘Extending Liddell a 'major concern' for worker safety, Kean says’, 6 March 2020 ↩︎

Renew Economy, ‘Why coal fired power stations don’t work so well when they are old’, 16 October 2017 ↩︎

New York Times, ‘Explosion at Coal-Fired Plant in Central China Kills at Least 21’, 11 August 2016 ↩︎

Jotzo et al, ‘Coal transition in Australia: an overview of issues’, September 2018 ↩︎

ibid. ↩︎

CFMEU Mining & Energy, ‘AGL Liddell plan ensures job security over 300 workers’, 12 December 2017 ↩︎

AGL Energy, ‘What is the Liddell Innovation Project?’, 31 July 2018 ↩︎

Latrobe Valley Express, ‘Loy Yang to remain until 2048: AGL’, 25 October 2018 ↩︎

Ewald, B., The health burden of fine particle pollution from electricity generation in NSW, November 2018 ↩︎

Environmental Risk Sciences Pty Ltd, Peer Review: Dr Ewald Report, 6 March 2019 ↩︎